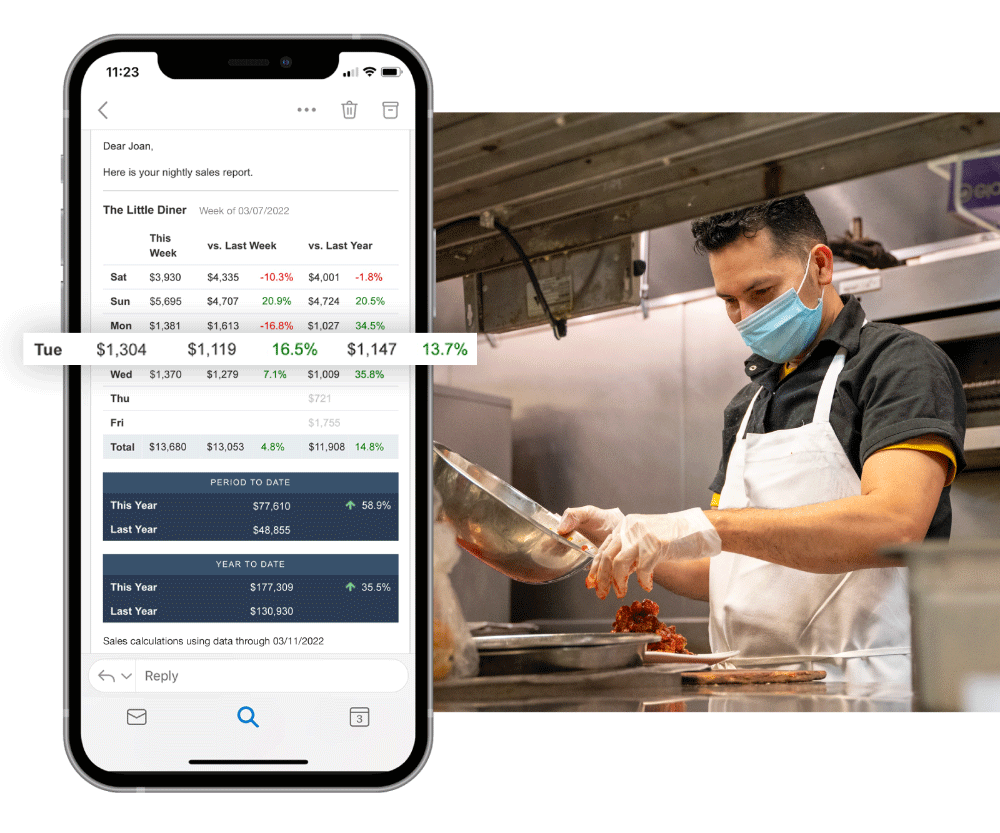

1Simplify your business.

Take control of the complexity of your business with real-time insights that help you make the right decisions, right now.

2Transparent pricing. Really.

MarginEdge costs $300 per month, per location when paid annually. Everything’s included, and there are never hidden fees. We promise.

Where We Help

-

Food Costs Control

FOOD COSTS CONTROL

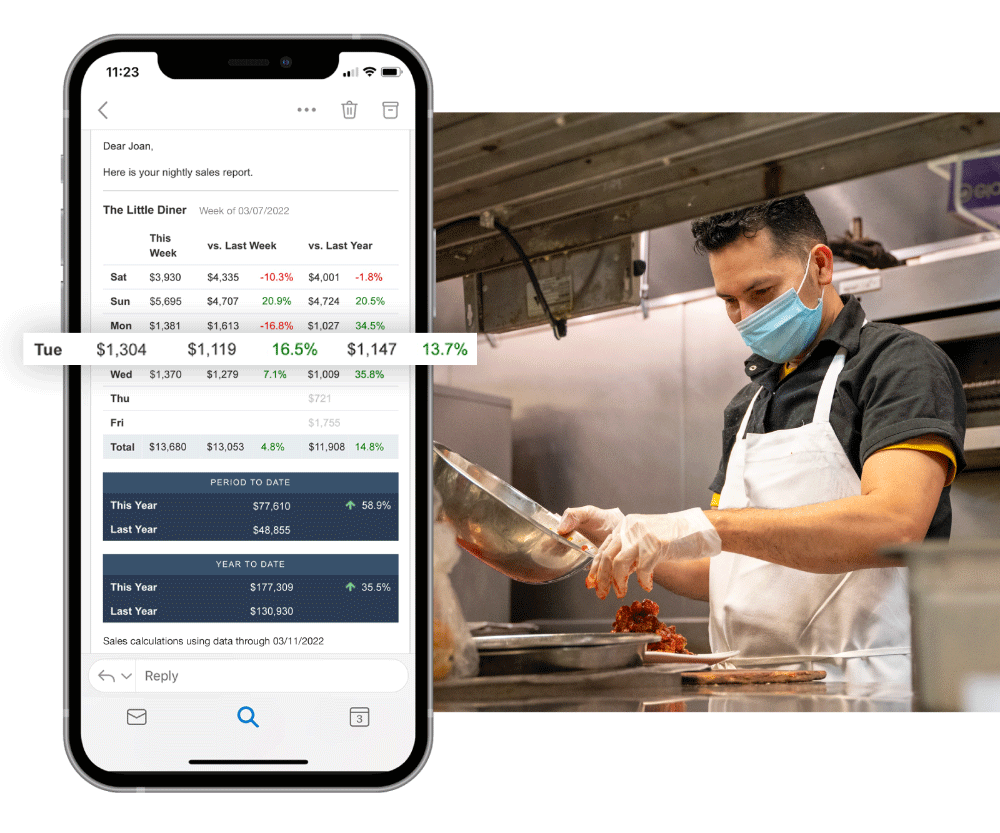

Know your food costs before the period ends

MarginEdge can show you practically every aspect of your restaurant’s costs in one place including daily P&Ls, price changes in your most-used products, and even food usage and waste. We update your reports as invoices come in so there are no surprises when the period ends.

-

Food Usage

FOOD USAGE

Inventories that are easier and more worthwhile.

No one likes inventories, but your on-hand counts provide meaningful data when it comes to measuring food usage. MarginEdge compares what you’ve purchased and what you’ve sold to what you’ve got left on hand, and we do the math for you. Free yourself from spreadsheet land.

-

Invoice Processing

INVOICE PRICING

Upload the way you want to, categorize the way you need to.

No one opens a restaurant because they want to do tons and tons of paperwork. As operators and owners, we knew there had to be a better way. So we made it our mission to stop restaurants from having to manually enter invoice data ever again with automated invoice processing.

-

Menu Analysis

MENU ANALYSIS

Menu engineering for the masses—math degree not required.

See theoretical costs based on real-time ingredient prices and PMIX data to pinpoint profitable and high-volume items. Compare menu items within a specific category, like appetizers, entrees, or desserts, to see which plates are contributing the most to profitability and which aren’t.

-

Back Office Efficiencies

BACK OFFICE EFFICIENCIES

Baby got back. Back office, that is.

Everything from bill payments, to ordering, to syncing with your accounting and POS systems — we’ve got you covered. Even orders from commissary kitchens and internal transfers between multi-unit locations are included! Manage product costs from when they come in the door to when they go out to the dining room, all in one place! MarginEdge is a holistic solution that takes care of all your back-office tasks.

Know your food costs before the period ends

MarginEdge can show you practically every aspect of your restaurant’s costs in one place including daily P&Ls, price changes in your most-used products, and even food usage and waste. We update your reports as invoices come in so there are no surprises when the period ends.

Inventories that are easier and more worthwhile.

No one likes inventories, but your on-hand counts provide meaningful data when it comes to measuring food usage. MarginEdge compares what you’ve purchased and what you’ve sold to what you’ve got left on hand, and we do the math for you. Free yourself from spreadsheet land.

Upload the way you want to, categorize the way you need to.

No one opens a restaurant because they want to do tons and tons of paperwork. As operators and owners, we knew there had to be a better way. So we made it our mission to stop restaurants from having to manually enter invoice data ever again with automated invoice processing.

Menu engineering for the masses—math degree not required.

See theoretical costs based on real-time ingredient prices and PMIX data to pinpoint profitable and high-volume items. Compare menu items within a specific category, like appetizers, entrees, or desserts, to see which plates are contributing the most to profitability and which aren’t.

Baby got back. Back office, that is.

Everything from bill payments, to ordering, to syncing with your accounting and POS systems — we’ve got you covered. Even orders from commissary kitchens and internal transfers between multi-unit locations are included! Manage product costs from when they come in the door to when they go out to the dining room, all in one place! MarginEdge is a holistic solution that takes care of all your back-office tasks.

It’s clear that MarginEdge designs their service with the empathy and experience of restaurant people. You aren’t just a tech company guessing at what we need—you know what we need—and it shows.

Emily Bruno, CAO

Denizen's Brewing Co

For the first time in running a restaurant I really feel that I know exactly what’s going on in all the finance and organizational parts.

Pepe Moncayo, Chef and Partner

Cranes

Every moment along the way, we were gaining new information from MarginEdge that motivated financially beneficial changes in our operations.

Todd Enany

Co-Founder, Sunday in Brooklyn

.jpg?width=1024&name=Bill-Es-DSCF7197-601x400-bf06395%20(1).jpg)

.svg)

.png)