Control cash flow. Protect food cost.

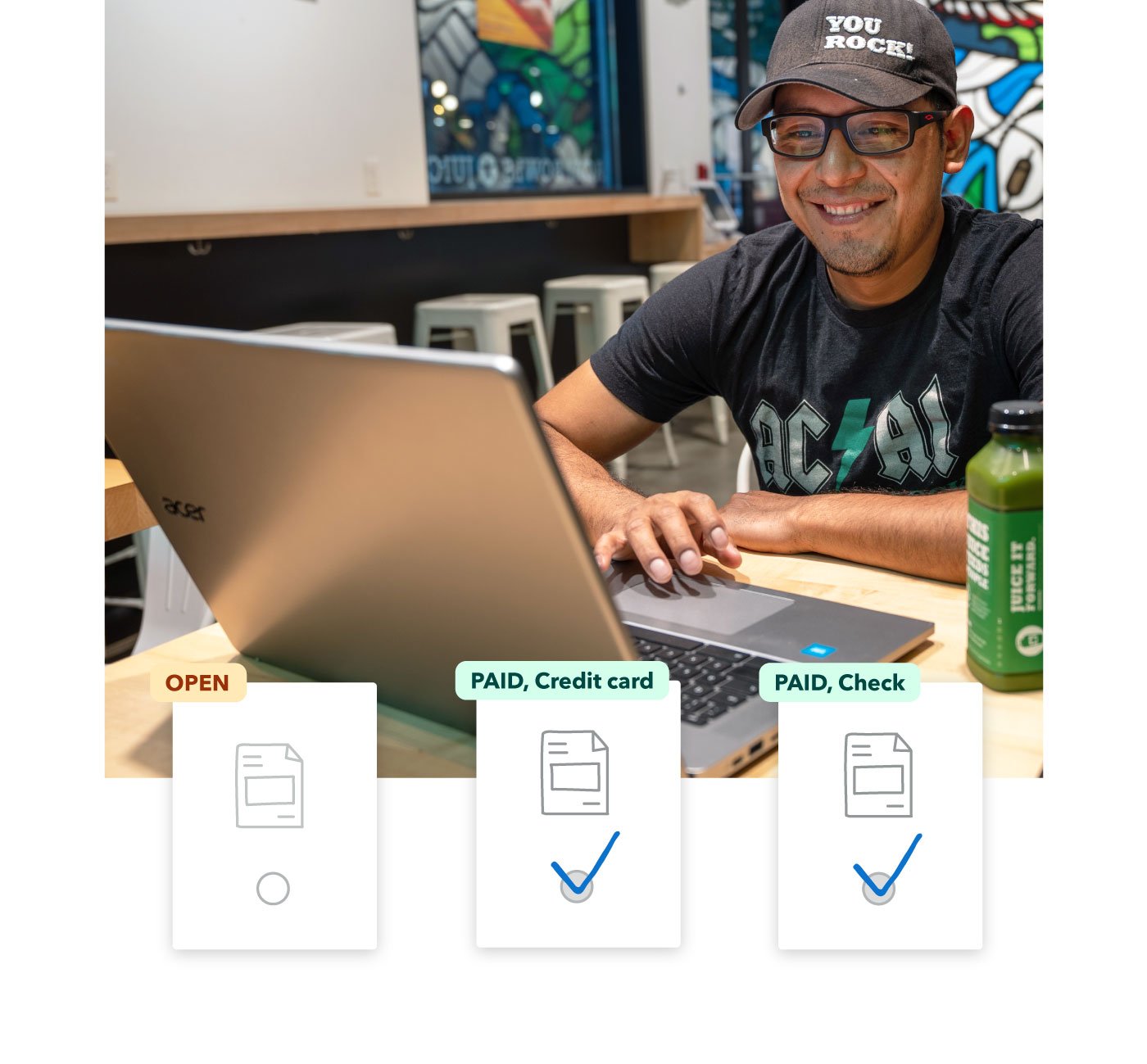

MarginEdge centralizes, bill approvals, payments and statement reconciliation, so you can control cash flow, avoid costly mistakes and trust that your food cost reporting is accurate.

With Bill Pay, you unlock 🔓

- Digital payments with full cash flow control

- Add your credit card to get more float

- Vendor statement reconciliation to keep costs and records accurate

Get started with Bill Pay

Get payments flowing so your numbers stay accurate.

Bill Pay FAQ

When will my vendor receive payment?

It depends on how you pay them:

- 2–3 business days for virtual credit cards

- 4–6 business days for ACH transfers

- Paper checks depend on mail delivery times.

You’ll see the payment status directly in MarginEdge, so you’re never guessing whether something was sent.

Can I pay a bill from my phone?

Yes. You can review, approve and schedule payments using the MarginEdge mobile app. The same control as the web, but on the go.

This is handy when you’re out of the back office or dealing with vendor questions in real time.

Can I make a partial payment?

Absolutely. You stay in control and choose to pay invoices in full or split them into partial payments as needed.

Note: This feature may not allow for accurate payment exports with all accounting systems. At this time, it is supported for Quickbooks, Intacct, Netsuite and Xero.

Why are my due dates wrong?

MarginEdge uses the payment terms set for each vendor to calculate invoices due dates.

If payment terms for a vendor aren’t set, the we default to the invoice date as the due date instead.

Can I cancel a scheduled payment?

Yes, as long as it hasn’t started processing yet.

Before the processing cutoff, you can cancel directly in MarginEdge. Once processing begins (especially for electronic payments), it may no longer be reversible.

If you’re unsure, contact Support right away and we’ll help you figure out next steps.

Ready for what's next?

Now that payments and reconciliation are under control, explore another feature that helps you tighten margins and reduce manual work. Back to phase 3 overview →

Stuck? We’ve got you 💙

For your first 90 days, email your Implementation Manager to guide you through setup and answer any questions.

After onboarding, our amazing Support team of restaurant vets is only a ticket away.