Bookkeeping Solutions & Consulting | Richmond, VA

Bookkeeping Solutions & Consulting | Richmond, VA

MarginEdge saves time and streamlines data

An integral part of a restaurant accountant's tech stack

Bookkeeping Solutions & Consulting LLC

- Location: Richmond, VA

- Client Type: Restaurant Accounting Firm

- # of Restaurants: 30

- Key Features: Bill Pay, Invoice Processing

The goal

Owner Trish Fields needed a solution for her restaurant clients that would save her time, allow her to grow and cohesively replace her piecemealed accounting tech stack.

[me] solution

Trish found MarginEdge, a leading restaurant management system that combined all of the tools she was looking for in one place. Trish was able to streamline and grow her accounting processes by using MarginEdge to automatically code her client’s invoice data into her accounting system, digitally pay bills all in one place, save time and reduce manual labor for her team, all while empowering her clients to be able to easily monitor and improve food costs.

“ MarginEdge is a huge time saver. I can spend that time doing lots of other things like budgeting and forecasting. And that’s really what I want to do, not the drudgery of going through a ton of paperwork and data entry. ”

Trish Fields | Owner

When Trish Fields started her accounting business, Bookkeeping Solutions & Consulting, in 2000 with mostly construction and service industry clients, she would not have guessed restaurants would one day become some of her easiest customers.

“Honestly, restaurants weren't my favorite because of the amount of paperwork involved.”

Anyone who’s worked in the back office of a restaurant knows exactly what she’s talking about. Trish explains, “I kind of swore off restaurants for a while, and I just did a lot of work for small firms like graphic designers and public relations firms. Then one of my friends who was a restaurateur and had several restaurants in town approached me about opening a new restaurant and said let's talk about the finances. He kind of talked me into it.”

When life hands you lemons, build your own tech stack

When the recession hit in 2008 and Trish was forced to reduce her staff, she knew she needed some kind of technology to address the mountain of paperwork still coming in the door each month. “We spent so much time dealing with paperwork and data entry,” she explains.

Being an early adopter of technology has served Trish well, particularly as a self-starter. “Earlier in my career I was doing bookkeeping for an accounting agency and after I met a couple of businesses, I decided I could probably do this on my own,” she notes, “So, I think that's when I realized that I might have the entrepreneurial bug.”

Even with the help of technology, Trish admits it wasn’t all sunshine and roses, “I was looking for software to solve some of these problems because I knew it was possible. We had these databases of information, right, their POS and their books. They should talk to each other. So I cobbled together my own little tech stack using an inventory platform, a bill pay platform and an accounting integration platform.”

Pretty soon, managing multiple platforms became an extra task in and of itself and Trish was back out looking for something better. She recounts, “I found MarginEdge just doing a search and that’s when I was introduced to Jill (Weston). MarginEdge had everything all in one place, and I couldn't believe how well it worked. I signed on almost immediately.”

“Now, we can always catch shorts without fail. So it's a huge time saver. I can spend that time doing lots of other things like budgeting and forecasting. And that's really what I want to do, not the drudgery of going through a ton of paperwork and data entry.”

Invoice woes, no more

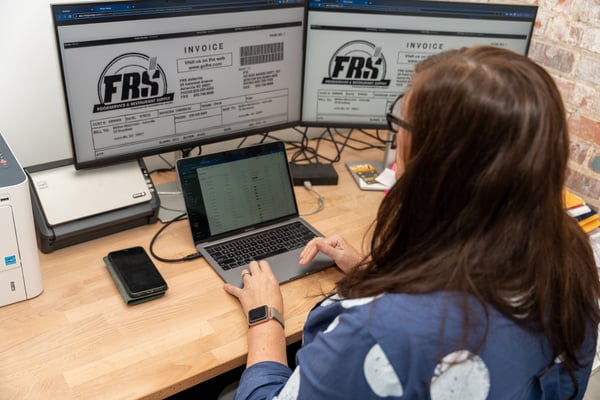

MarginEdge was able to solve one of the biggest challenges restaurant bookkeepers and accountants face: invoice processing. Turning all those receipts and paper into usable financial data used to take hours’ worth of work and multiple people to cover all the data entry. With MarginEdge, all her restaurant clients have to do is snap a photo of the invoice and in 24-48 hours all of the line item data (including hand-written scribbles) is in the platform and exported to their accounting software.

“For my restaurant clients, getting them to learn how to scan invoices is the first part of it. That's where the rubber meets the road,” she explains. But as with implementing any new piece of technology in a restaurant, there was bound to be some resistance. Trish says, “A few of them were resistant to doing it, but once you teach them how to use the MarginEdge mobile app, it's completely easy. And if they still don't want to do that, they can send in a batch right to an email address and MarginEdge extracts the data that way.”

Invoice data and sales data (which gets pulled from her clients’ POS daily) are pulled into her accounting software each night, so she and her clients have an up-to-date understanding of their financials including COGs and a daily P&L.

And when errors come up, because no software is perfect 100% of the time, Trish and her clients know they’re supported by a team that truly cares and understands. She says, “MarginEdge has been great at communicating with me. If I have a question, it's been really amazing to be able to get in touch and have my questions answered. Support has always been really responsive. The help desk library is amazing, but if I can’t find the right help article, I know I can reach out to the support team and they get back to me right away. I'm on a first-name basis with Natasha, Brendan and Nick. I'm sure they love getting emails from me, but the help has been wonderful.”

Price alerts mean big savings

The ability to easily track product prices is another big benefit that comes with having invoice data digitized and at her clients’ fingertips in near real-time. “A lot of my restaurants’ chefs would look back and go, ‘Oh my gosh, the price of a case of crabs went insane!’ You couldn't even put it on a menu and if you did, you had to charge fifty dollars for an entree – which no one wants to do. If the kitchen wasn't paying attention, you'd see them flipping through all the receipts, like, ‘Wait a minute, I didn't realize I was paying this,’ and they just lost a ton of money when they could have switched to another item,” she recalls.

With the Price Alerts tool, MarginEdge not only makes Trish’s life easier but also the lives of her restaurant client’s chefs (talk about a win-win). She explains, “Having the Price Movers is very helpful, and if any of the chefs were hesitant, their resistance was met and overcome with just that one function right there.”

If product prices go outside a certain set range, there’s a notification and the operations teams can make changes in the moment, without added effort. Traditionally this would require hand-tracking prices from the invoices as they came in and staying on top of sometimes hundreds of ingredients, which can take hours of work every month. MarginEdge does the work so operators have more information and more time to focus on the menu and their guests.

“There’s just so much good about Bill Pay, especially the fact that I can always look at the data in two places – both in MarginEdge and in my QuickBooks files – because the information just slides over and is super helpful.”

Time savings for Trish

Having her clients’ POS data automatically synced to their accounting system has been a huge time saver for Trish. She recalls, “That was a huge time suck for me. It was an enormous time waster because you can make so many mistakes when you're entering all that data.” Now that data is automatically pulled nightly, and mapped to her chart of accounts exactly the way she wants it to be.

Trish explains, “I have a standard chart of accounts I use for most people, and mapping all that just saved so much time. You set it and it's done – you don't have to worry about it again. I used to have an assistant that would enter all that data, and it would take her all day to enter data for the whole month.”

Before MarginEdge, the weekly journal entries would be riddled with errors she had to individually go in and fix. She notes, “There was no way to catch overs and shorts each day, you know? Why doesn’t this day’s sales match the credit card deposit? And that would take four or five hours. Now, we can always catch shorts without fail. So it's a huge time saver. I can spend that time doing lots of other things like budgeting and forecasting. And that's really what I want to do, not the drudgery of going through a ton of paperwork and data entry.”

With the MarginEdge integration, Trish is able to provide her clients with impactful reports faster.

She explains, “Now my clients’ prime costs can be really quickly identified, and I'm able to usually promise full financial reports to my clients by the 15th of each month. Sometimes they're out by the fifth. That's never been possible in the past.”

Who knew paying bills could be enjoyable

Along with reports, Trish has also been able to streamline her bill payment process. With the included Bill Pay module in MarginEdge, Trish and her restaurant clients can schedule payments including partial and automatic payments, while still being able to cross-reference the invoice it’s related to all in one place.

This means the risk of over or underpaying vendors is virtually nonexistent because you can view the digital scan or copy of the invoice as you schedule the payment. She explains, “It's shortened my process so much. There's no reason to ever write a check again, it's crazy.”

As with most things in the restaurant industry, time is money, and being able to make payments quickly can be critical to avoid late fees and tarnished relationships. Trish notes, “The Bill Pay process is already really good and you guys keep working on it, which is really amazing. You shorten the ACH payment turnaround to like a day or two.”

Bill Pay also gives Trish peace of mind and an added layer of information thanks to the integration with her accounting software and nightly data pulls carrying payments over automatically. “There’s just so much good about Bill Pay, especially the fact that I can always look at the data in two places – both in MarginEdge and in my QuickBooks files – because the information just slides over and is super helpful,” she explains.

"I could not have done it without MarginEdge. Honestly, straight up."

Post-pandemic prosperity and what’s coming next

Even though the uncertainty of the pandemic is now safely in our rearview, its impacts (both good and bad) still linger. During the early months, Trish wasn’t sure how she could continue helping her clients that had to shut down.

Thankfully, that keep-moving-forward, entrepreneur bug in her kept her business going, as she notes, “I used down time during COVID to be in contact more with my restaurant clients because I had this tool for analysis and could figure out whether or not they could move forward. Now I include MarginEdge in all my new quotes, it’s a part of my tech stack.”

Instead of closing up shop or seeking out other non-restaurant clients, she was able to turn a difficult time and situation into an opportunity. “MarginEdge just gave me a lot of time back, and I'm able to pursue other things. And during COVID I didn't get slower. I got busier,” she says. So much busier that Trish has decided to focus solely on gaining restaurant clients moving forward.

Trish explains further, “I didn't know what was gonna happen during that time, and I turned it around to do more work and help more people, and honestly, it's made my life so much better. I said, you know, let's go, let's get this done. And it's been so much fun, and I could not have done it without MarginEdge. Honestly, straight up.”

And to be fair, we couldn’t have done it without partners like Trish either.