Restaurant Sales – DC – July 2020

July Stats + Spotlight on Delivery Sales

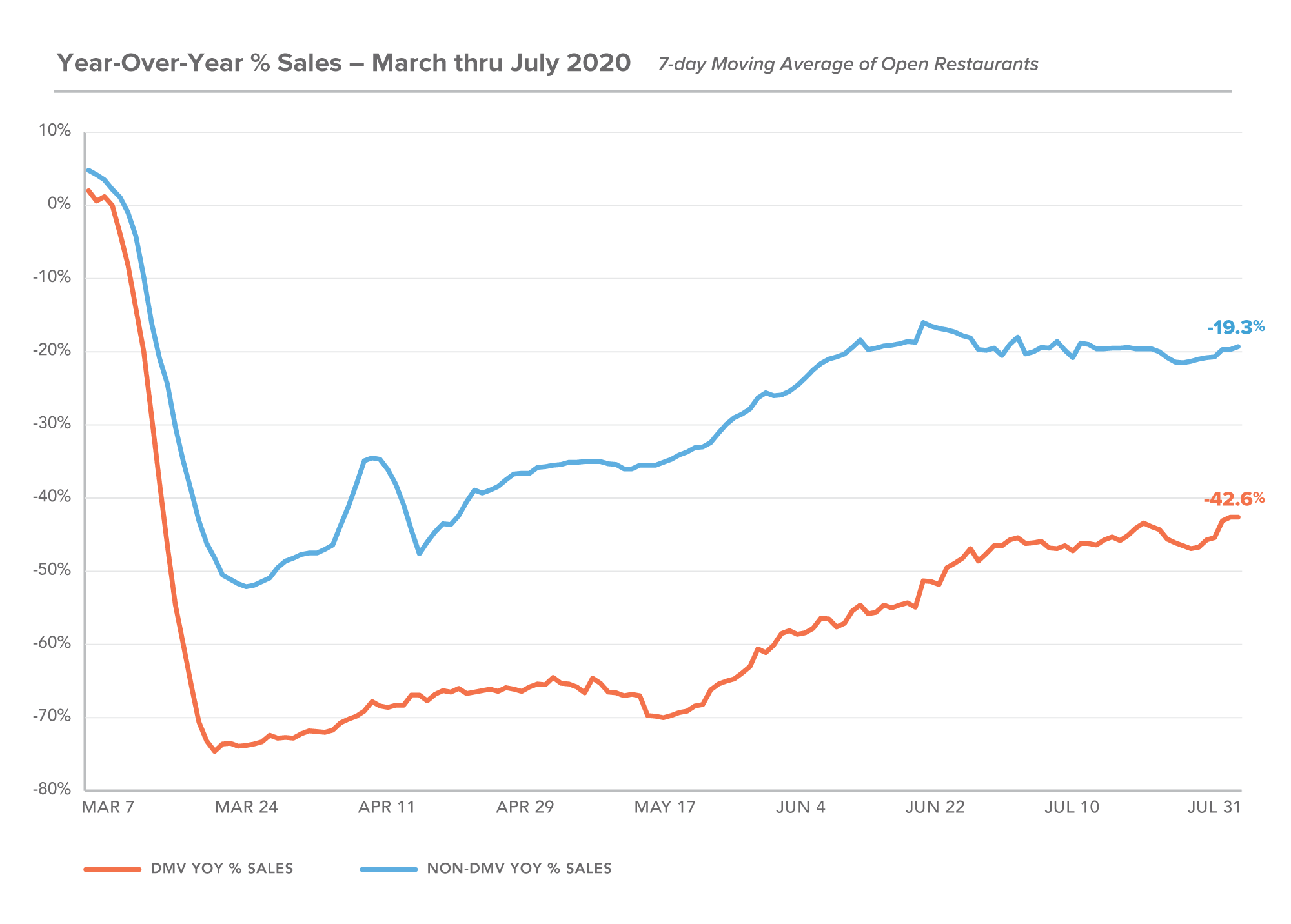

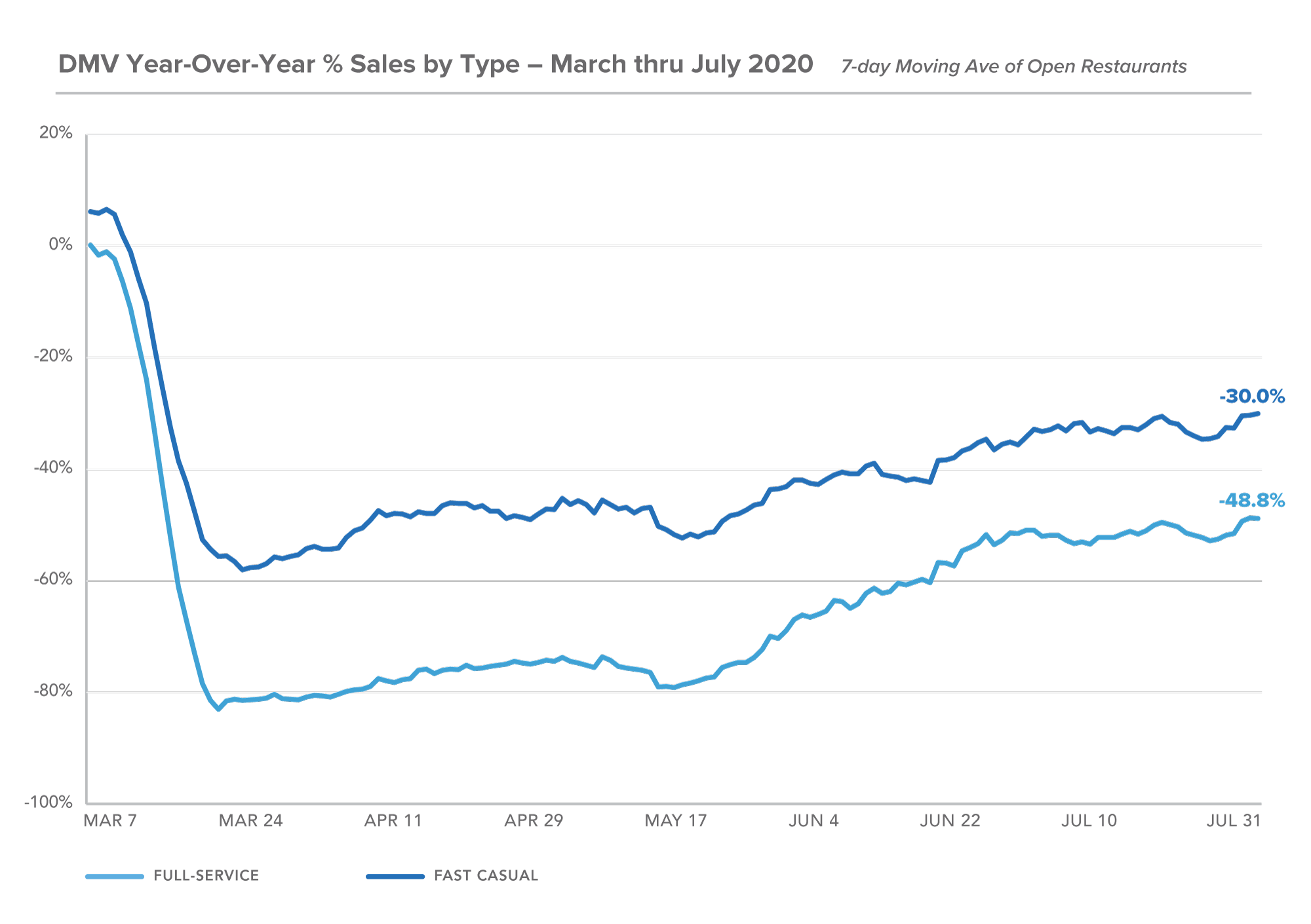

While year-over-year sales for DMV restaurants are down considerably compared to the rest of the country, the trend is now going in the right direction, recovering after a dip in mid-July. Fast-casual restaurants are supporting the year-over-year figure with sales down only -30% compared to full-service restaurants which are down -48%.

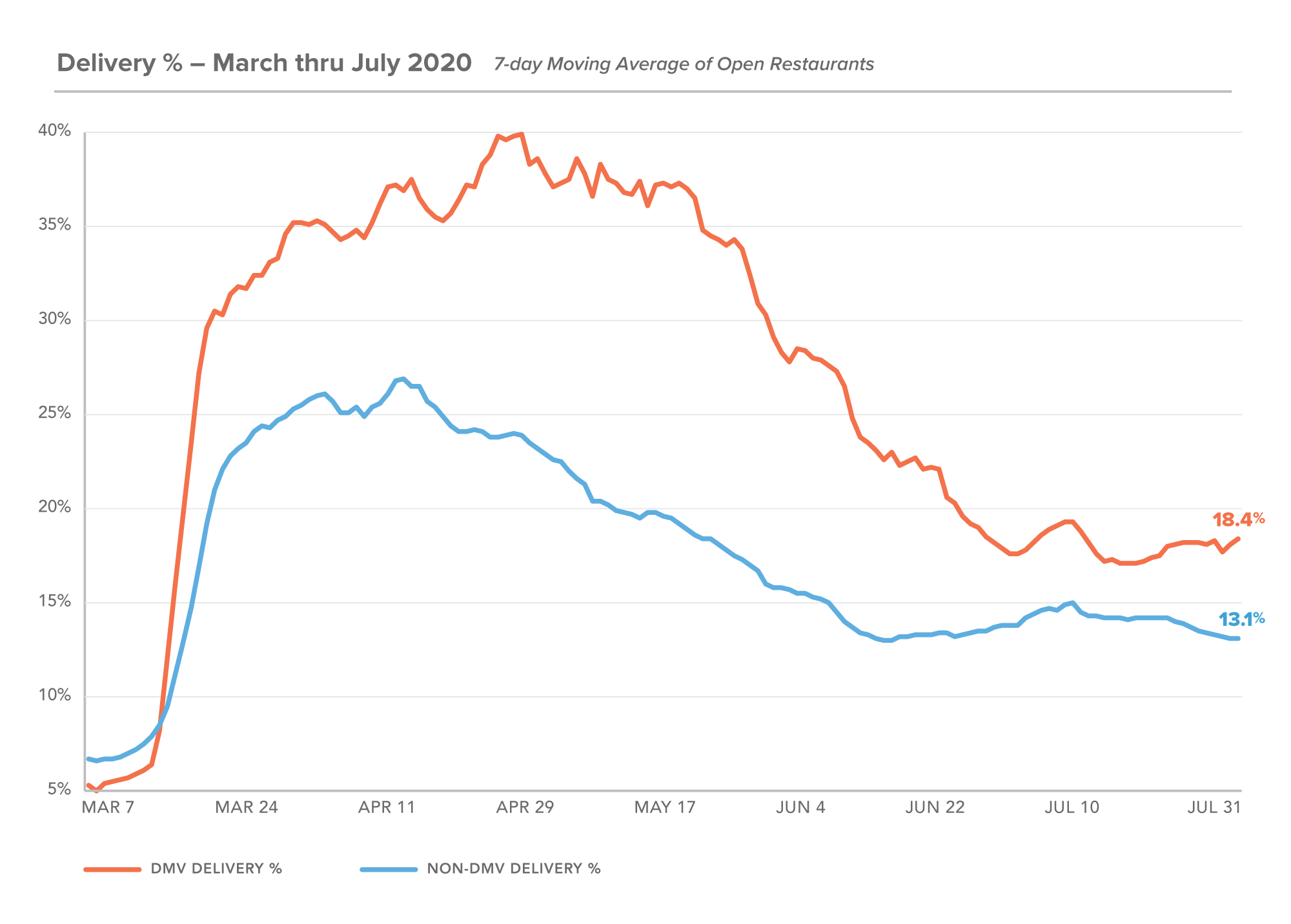

Our goal with sharing our data is to arm restaurants to make the best decisions and plan for the future – which has as much to do with top line revenue as bottom line profits. The pandemic has increased the collective dependence on third party delivery partners which typically mean less profits per order, so we included a view on delivery as a percentage of sales to help understand the trends.

Before the pandemic, delivered food made up about 5% of a restaurant’s sales. This stat reached 40%, and is now 18.4%. We’re hoping to see that number go back down but the reality is we probably will never see pre-pandemic delivery percentages again, which calls restaurants to re-think how they can make delivery as profitable as walk-in sales.

Non-DMV delivery % of sales is lower than DMV but that is what we would expect from less metropolitan areas with less robust third-party delivery saturation.

Email Updates

Sign up to receive our emails for sales data, updates and resources as our community navigates Covid-19.

SIGN UPAbout these metrics: The MarginEdge monthly snapshot of DC Metro restaurant sales is based on a sampling of 300+ area restaurants ranging from fast-casual to full-service.