Update on SBA Loans and Daily Stats

Things are changing by the hour - a phrase I always thought was silly until this past week. We are doing our best to keep up and while none of us know exactly how any of this will shake out, we will continue to send along anything we learn along the way. Last night new programs were passed into law related to FMLA and SBA loans but neither has any real detailed regulations yet so we will update on those later.

For now here is what we know for existing programs:

A few updates on SBA Disaster Loans. The way we understand it, to qualify you have to be unable to meet your current financial obligations or pay your regular expenses (I mean, I think having zero revenue certainly qualifies here). The amount you can borrow will be based on how your business has been affected, with a max borrowing limit of $2 million. Our understanding is the rates will be at most 4% with a 30-year term.

You can also apply for a standard 7(a) SBA loan, which will likely be processed and disbursed more quickly than a SBA Disaster Loan, albeit with a higher rate (5-6%) and a shorter payback period. But with these loans the issuing bank is taking part of the credit risk, so I would only advise starting a conversation on these with a banker you are already close to and knows you well enough to know you will re-open. Applying to a new bank when you have approaching $0 revenue feels like a fools errand to me but if it works for any of you let us know!

- FICO score > 650

- No bankruptcies in the last 5 years

- In business for at least 2 years

- Positive cash flow last year

Legislation working its way through Congress appears to enhance 7(a) SBA loans with the following proposed changes:

- Allow 7(a) borrowers to use loan proceeds for payroll support, including paid sick leave

- Waive all fees for all 7(a) loans for one year for both lenders and borrowers

- Provide a 90% government loan guarantee (incentivizing partner lenders to offer more SBA loans)

- Increase the limit for SBA Express Loans (which function as a Line of Credit) from $350,000 to $1 million

- SBA Express loans have a 36-hour turnaround time

All of this is taking shape in real time, and our team is working diligently to stay on top of the latest. With the stimulus bill passed last night more changes are likely on the way, but we are hopeful they only increase the size and scope of relief.

On a personal note, I've applied and the status of my application is "in review". I will share my experience securing these loans in an effort to help shed some light on what we can expect for process and timing.

Also, we just launched a site that pulls together the emails we've sent this week, a quick view on today's insights and resources from around the industry. There is a form to sign up to receive these emails for those of you asking the best way to include additional people on this email list, and a form to sign up for our free basic product to help businesses with daily insights and help build the value/accuracy of our data set.

https://me.marginedge.com/covid

If there are resources you think we should include or other information you would like to see captured here, please let us know.

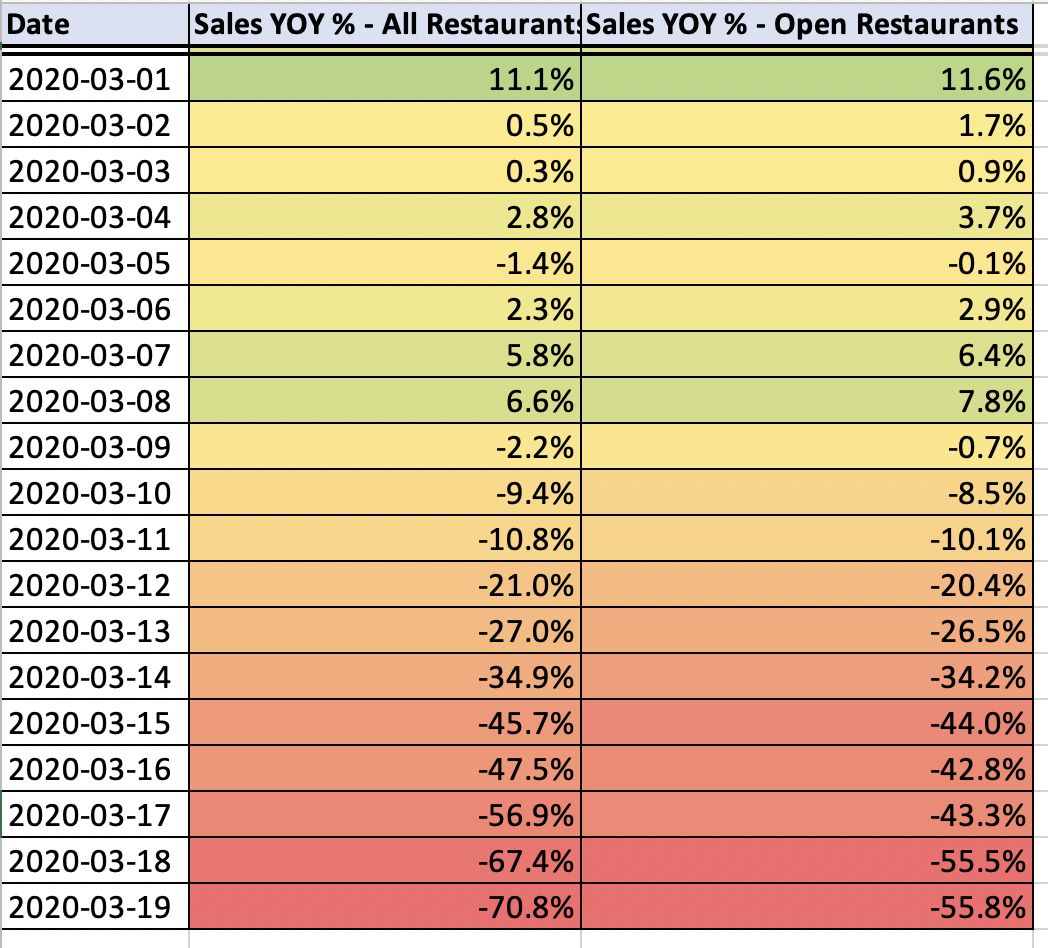

Last thing, please see the year over year, daily stats posted below.

Grateful to be weathering the storm with this community.

Stay safe,

Bo