November National Restaurant Sales Metrics

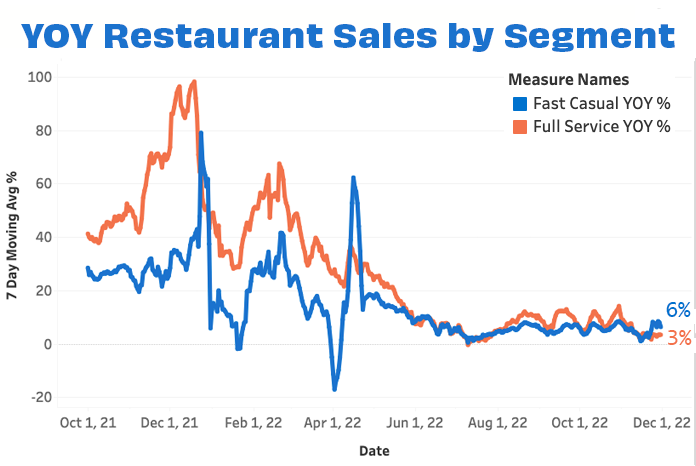

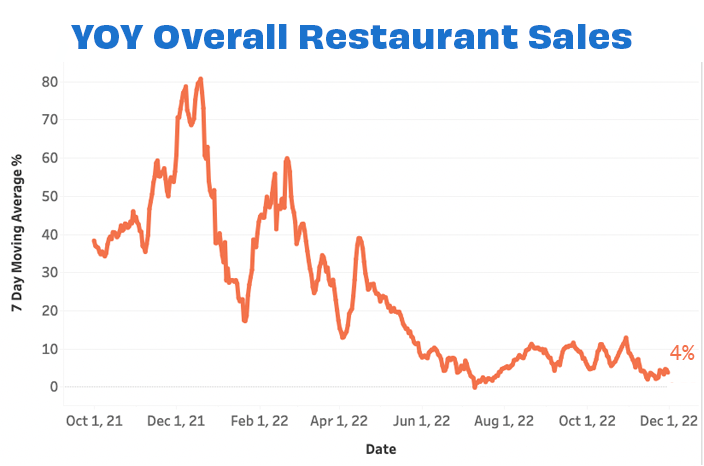

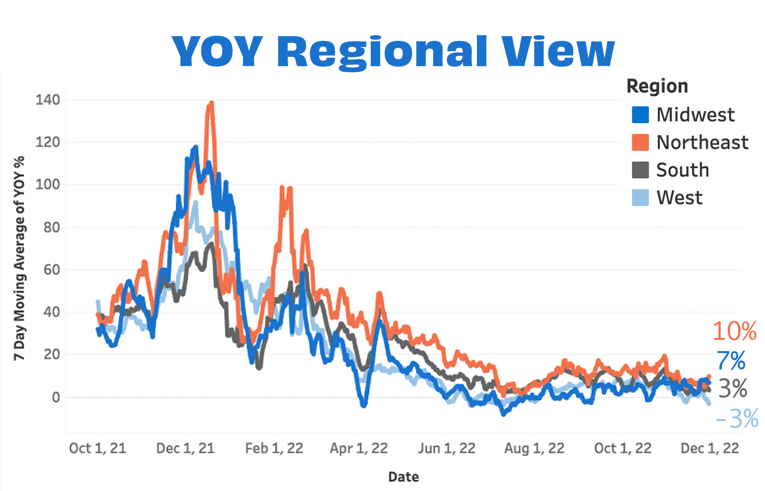

Growth slowed in November, but still remained positive compared to last year's numbers.

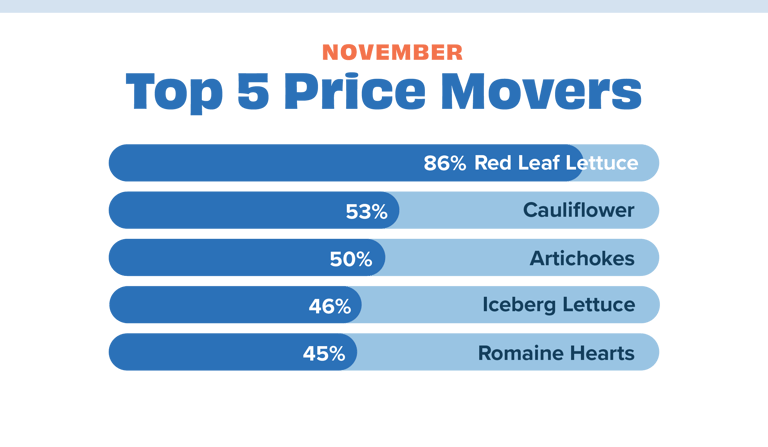

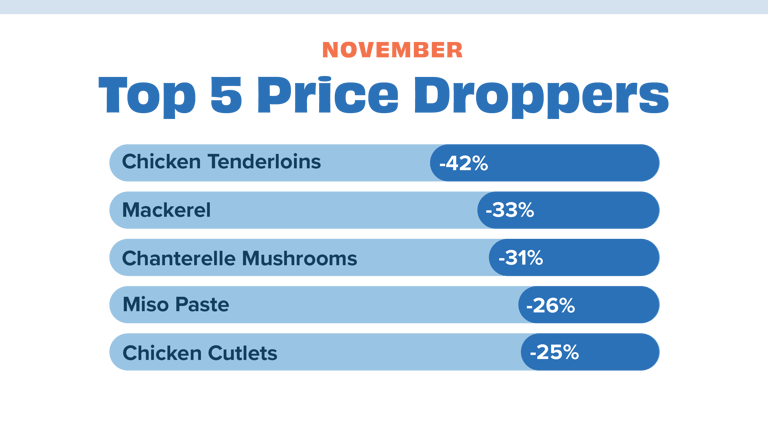

Once again, lettuce topped (and filled out) our Mover's chart, while chicken tenderloins topped the Droppers chart. Not making the list at all, whole turkey costs thankfully (ba-dum tss) played nice this November, increasing only 7% compared to October 2022's prices.

With the holidays come bigger swings in terms of daily sales, so for November and December we wanted to take a more granular view. Over the majority of 2022, sales have remained incredibly stable across both segments so the day-to-day swings now represent more nuance than the chaotic swings brought to us by pandemic shutdowns.

With that in mind, sales broken down by segment show Full Service at 3% higher than November 2021, and Fast Casual at 6%. Fast Casual's rise happened during the last week of the month (no doubt spurred by post-Thanksgiving cooking burnout), so we're crossing our fingers that Full Service's luck will change during December. Overall, national restaurants ended the month at 4% higher sales than last year.

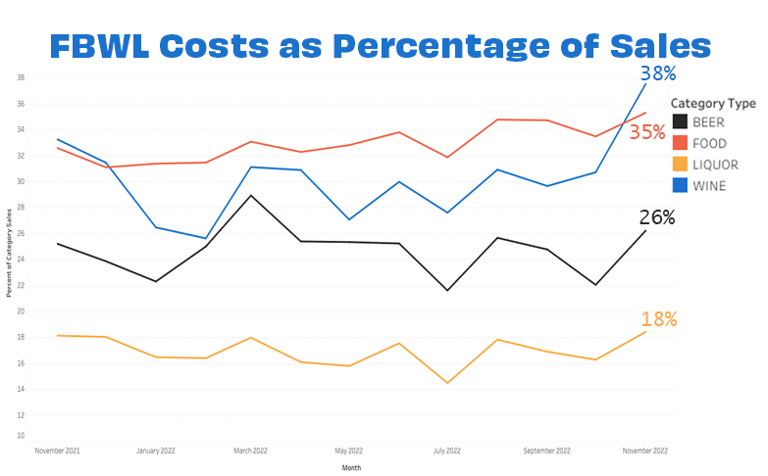

Food and beverage costs were slightly up from the end of last quarter, with the food category reaching 35% of sales and wine at 38%.

We hope you all have a safe, healthy (and busy!) holiday season. We'll see you in 2023!

![[Sign up for our newsletter] Get sales data and restaurant insights straight to your inbox each month](https://no-cache.hubspot.com/cta/default/6423873/2b19fcb4-92a7-41e5-8a2f-75a74dad0c24.png)