The Board: November 2025

This month we look at: egg prices, the top 3 ways operators burn money without realizing it, how one restaurant organization is doing good while solving the restaurant labor crisis, inflation and national restaurant sales trends from October.

Greetings from that not-so-magical time of year where it gets dark at 4:30 PM! It has been a news-heavy November so far, particularly with the country trying to navigate the longest government shutdown in American history and all the fallout left in its wake, like how it impacted restaurant sales last month.

With enough doom and gloom already out there, I hope this newsletter will bring some brevity to your day (starting with checking out the What's Making Us Laugh reels below!).

On a positive note, we've got some very exciting content in this month's edition, including some info in our 'Tis the Season section on an incredible organization that's solving two needs with one restaurant business: Emma's Torch, as well as some tips on where you might be burning money without realizing it from some trusted CPAs.

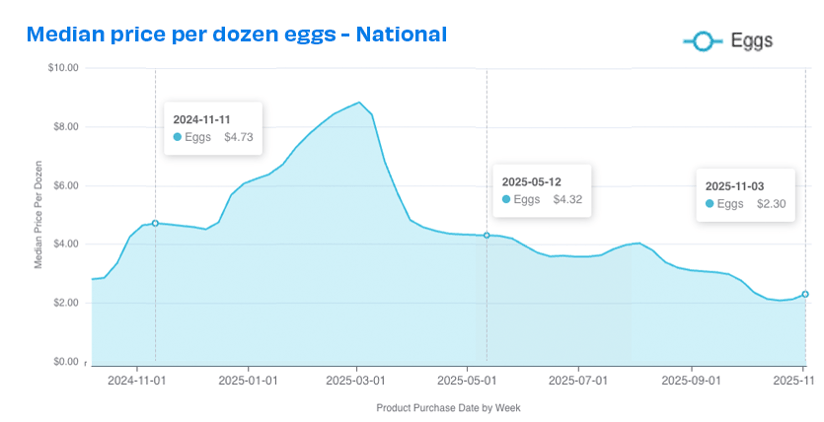

And on another positive note, we have some egg-tremely good news about egg prices in our Item to Watch section, too!

The holidays can be a difficult time for many, particularly in our industry, as many end up celebrating these special nights with their work family instead of their home family and friends. We see you, we deeply appreciate you, and we wish you all a safe and profitable Thanksgiving! We'll see you in December!

Know someone who would like to join our 98,728 subscribers? Forward to a friend or send them this link.

- Rachel & the MarginEdge team

P.S. If you took our very, very accurate Restaurant Personality Type quiz, your November mantras are here!

MONTHLY SALES METRICS & UPDATE

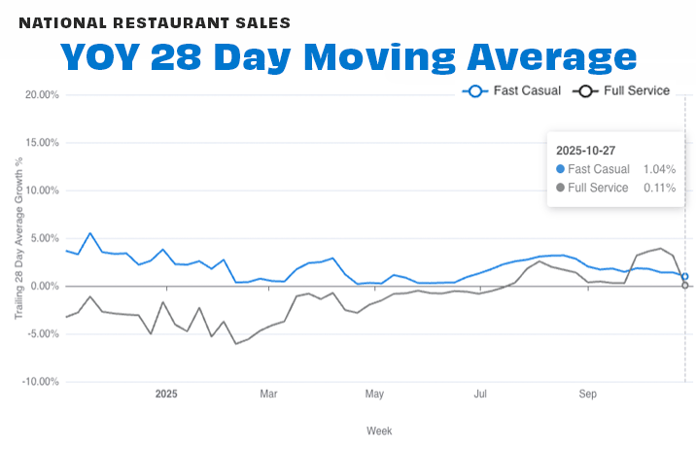

The trailing 4-week (28-day) average of year-over-year (YOY) sales for Fast Casual came in at +1.0% and Full Service at +0.1% at the end of October compared to 2024 sales.

Food costs averaged 29% of sales last month, representing a -1% drop from the average in September.

ITEM TO WATCH

Eggs

After an egg-pic price disaster earlier this year, egg prices have fallen to their lowest levels in more than 12 months - just in time for all that holiday cooking! Why? According to the USDA, production is now outpacing consumption. But TBD on if that changes as baking ramps up over the next two months.

For MarginEdge customers, the median price per dozen last week was $2.30, which has decreased -47% from 6 months ago, and -51% from 12 months ago.

Salt & Vine | Olney, MD

ASK [me] ANYTHING

What are the top ways operators burn money without even realizing it?

Restaurant accountants see the full spectrum of financial decisions made by their clients—some brilliant, others baffling. While it’s rewarding to witness clients succeed by following sound advice, it’s equally frustrating to see avoidable mistakes that stem from rushed, fear-driven decisions. Heading into 2026, we asked our friends at Harmony CPAs, whose mission is to help restaurant owners sidestep these financial pitfalls, about the top three ways restaurants burn money without even realizing it—and how to avoid them. Here's what they said:

1. Instant deposits

Problem: Instant deposits from POS systems or payment platforms may seem like a quick fix for cash flow, but they come at a staggering cost. A 1.75% fee for a 2-day advance translates to an APR of over 2,000%.

Impact: A $2M business using instant deposits daily could lose $35,000 annually.

How to avoid it:

- Delay payables by a few days—most vendors are flexible if you communicate.

- Address underlying cash flow issues by cutting costs, raising prices, or improving operations.

- Consider alternative loans with lower interest rates, even credit card loans, which are far cheaper than instant deposits.

2. Merchant cash advances (MCAs)

Problem: MCAs are predatory loans with hidden costs. Borrowing $90,000 and repaying $119,700 may sound like a 33% fee, but the actual APR often exceeds 70%.

Impact: These short-term fixes trap businesses in a cycle of high-cost borrowing, making it hard to achieve long-term financial stability.

How to avoid it:

- Seek personal loans or alternative financing with more reasonable terms.

- Fix structural business issues—identify and address profitability challenges with expert help.

- Consider selling equity to bring in investors, ensuring long-term stability over short-term fixes.

3. Not contributing to a retirement plan

Problem: Many restaurateurs avoid setting up retirement plans due to perceived complexity and low staff participation.

Impact: Missing out on tax savings and wealth-building opportunities. Contributions can yield first-year returns of 40-50% through tax deferrals, and government tax credits can offset start-up costs.

How to avoid it:

- Work with a small-business-friendly retirement advisor to explore options like 401(k) plans.

- At a minimum, maximize contributions to Traditional or Roth IRAs.

Avoiding costly mistakes requires vigilance and expert guidance. This month, we're partnering with Harmony Group to offer six operators a complimentary P&L review session (a $1,500 value). Don’t miss this opportunity to step up your restaurant’s financial game! Learn more here.

💬 Ask [me] anything!

Really. Each month we’ll take a look at the questions we get and answer one here. Have a question about our product, accounting, or restaurant operations in general? 💌 Email me or message us on our social media channels.

The Local | Fallston, MD

THE ECONOMY

Inflation

The September 2025 Consumer Price Index (CPI) report is in, and indicates the following month-over-month changes in food inflation:

- Overall Food Inflation: Up at 0.2% from August, and is up 3.1% YOY.

- Food At Home: Up 0.3% from August, and is up 2.7% YOY.

- Food Away from Home: Up 0.1% from August, and is up 3.7% YOY.

- Limited Service Meals: Up 0.2% from August, and by 3.2% YOY.

-

Full Service Meals: Unchanged from August, and up 4.2% YOY.

Overall, inflation came in at 0.3% up from August, putting year-over-year inflation at 3.0%, another increase from last month's YOY. Gasoline was the biggest contributor to the increase. The Federal Reserve cut rates in October by 25 basis points, and they will likely do another cut in December as the labor market data have cooled.

Tl;dr - Both grocery and restaurant prices continue to increase but are slightly down from last month's YOY percentages.

Emma's Torch | Silver Spring, MD

'TIS THE SEASON

Where talent meets opportunity: Emma's Torch

- Their model: Students complete a fully paid, 11-week training designed to prepare them to enter directly into the restaurant industry. They learn in a hands-on environment in the kitchens of the Emma's Torch social enterprise cafés and catering businesses, practicing knife skills, food safety, and cooking techniques – all while attending classes and mentoring sessions designed to develop critical English language, professional communication, and career advancement skills.

- Fulfilling an industry need: Restaurants everywhere are struggling to recruit and retain staff. Emma’s Torch helps fill this gap by creating a pipeline of highly motivated, well-trained graduates who are ready to step into kitchen roles.

- Their employer-ready graduates: Over 600 graduates have completed the program since it launched in 2017.

- 88% are hired into culinary jobs within three months of graduation

- 82% stay at those jobs for over 6 months – triple the national average for retention.

- Why this matters for our industry: Supporting Emma’s Torch doesn’t just change lives: it strengthens the restaurant workforce pipeline at a time when staffing shortages are one of the sector’s biggest challenges.

What's [me] into😂 WHAT WE'RE LAUGHING AT

📖 WHAT WE'RE READING

🎧 WHAT WE'RE LISTENING TO

|

![[Sign up for our newsletter] Get sales data and restaurant insights straight to your inbox each month](https://no-cache.hubspot.com/cta/default/6423873/2b19fcb4-92a7-41e5-8a2f-75a74dad0c24.png)